KEY POINTS

1. We expect emerging markets debt to continue benefitting from global disinflation and prospects for rate cuts, which already supported stronger performance in late 2023.

2. As ever, country selection remains key in emerging markets to capture the most attractive idiosyncratic risk and opportunity in this broad and diverse investment universe.

3. We foresee stronger appetite for EM debt in 2024, with net flows returning to positive territory as investors come back to the asset class.

Boston - In the final quarter of last year, emerging markets (EM) debt produced strong positive performance across all segments, as currencies strengthened versus the U.S. dollar, interest rates fell in most world economies and credit spreads tightened.

Weaker U.S. economic data has been viewed by the market as an initial sign that the U.S. Federal Reserve (Fed) may have finished its hiking cycle and is seeking to engineer a soft landing. The Fed seemingly confirmed the market view with its dovish pivot in December, which was the most notable event of the quarter for the asset class (and risk assets in general).

Oil prices are key to the disinflation story. They fell dramatically due to a strong global supply response, which helped the Fed and other central banks pursue a more accommodative path forward.

In emerging markets, we saw a number of central banks move to cut rates, as inflation is well-contained in many countries and there is leeway due to high real rates locally.

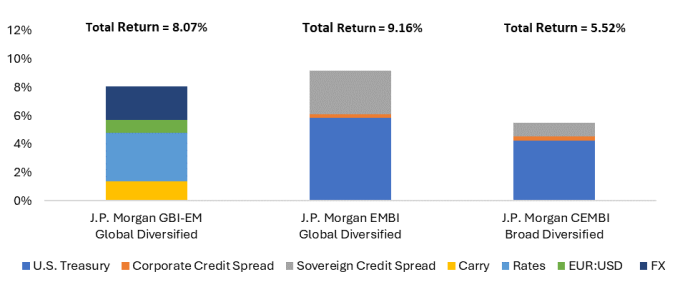

As noted, all EM debt indexes produced strongly positive total returns.

- The USD-denominated sovereign index within the EM debt universe was the best-performing segment, as spreads approached their tightest levels of the year and the notable fall in U.S. Treasury yields provided further support.

- The local segment was the next strongest performing with most EM currencies strengthening versus the U.S. dollar and most interest rates mirroring the move lower in the U.S.

- The corporate space was up the least among EM debt segments, but still produced notably positive performance, too, as spreads tightened substantially and also benefitted from the fall in U.S. Treasury yields.

Narrowing Hard-Currency Spreads Drive Returns

Source: JP Morgan, Morgan Stanley Investment Management, December 31, 2023. Past performance is no guarantee of future results. Data provided for informational purposes only. It is not possible to invest directly in an index. The vertical axis reflects the amount contributed by each factor to total return - adding the bars above 0% and below 0% (negative numbers) results in the total return. FX is the gain or loss in the GBI-EM from currency changes relative to the U.S. dollar. EUR:USD reflects the portion of currency movement in the GBI-EM that is explained by the change of the euro versus the U.S. dollar. Rates refers to the contribution of change in local-currency interest rates in the GBI-EM. Carry refers to the risk-free returns in each GBI-EM country that cannot be attributed to FX, EUR:USD or rates. Sovereign credit spread refers to the spread above U.S. Treasurys in the EMBI paid by a country. Corporate credit spread is the spread above the sovereign spread paid by an EM corporate issuer. U.S. Treasury refers to the contribution to return in the EMBI and CEMBI (both dollar-denominated indexes) due to interest-rate changes on the U.S. Treasury.

Rate Cuts Ahead?

A number of EM central banks cut policy rates in 2023 and we expect that to continue into 2024. While that is likely to be good for local bonds, it will also likely be further supportive of growth in those countries and potentially benefit all assets.

In addition, the Fed's dovish pivot is likely to be broadly supportive in 2024. Dovish monetary policy from many EM central banks may become even more notable in the near term, as the Fed changes course. The combination of high real yields, broad disinflation and central banks cutting rates across EM is likely to provide a good environment for local bonds.

Oil prices will remain important, too. They have declined notably and toward levels that ease the burden on importers. These levels will likely continue supporting the global disinflation narrative, while also remaining high enough to support EM exporters of oil.

Countries Count Most

China's sluggish economic recovery and lack of support for its property sector may keep its growth relatively low for years. As such, we believe foreign capital may seek out other EM opportunities. Accordingly, we expect more capital flows into other, well-run EM countries in the region and beyond (e.g., Mexico is a prime candidate).

Notably, a number of large EM countries, such as Turkey, Nigeria, Argentina and Venezuela, which all faced market skepticism in the past, experienced meaningfully positive events in 2023. While caution is advised, each country may be investable again this year.

While flows out of dedicated EMD funds were very large in 2023 (after record outflows in 2022), we expect that pressure will abate as the attractiveness of the asset class draws investors back.

Bottom line: A number of EM central banks cut policy rates in 2023 and we expect that to continue into 2024. While that is likely to be good for local bonds, it will also likely be further supportive of growth in those countries and potentially benefit all assets. Growth, inflation and policy outlooks are quite divergent across the heterogeneous universe of countries we refer to collectively as "emerging markets." As such, we continue to expect markets to place an emphasis on differentiation among EM countries and credits.