KEY POINTS

1. We see strong tailwinds for growth over the next decade, including India's young population and ongoing policy reforms that support a strong infrastructure.

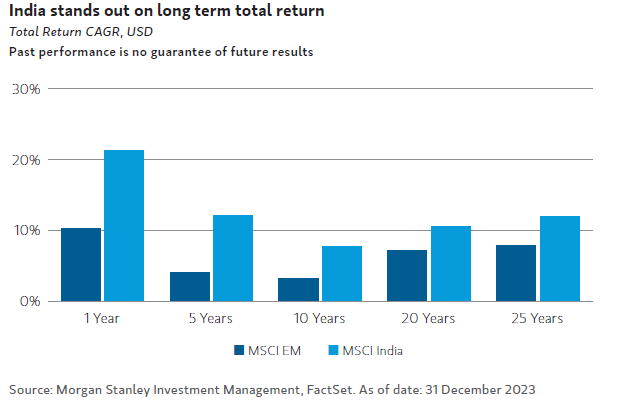

2. While underrepresented in equity indexes, India has consistently demonstrated stand-out performance, outperforming the S&P 500 Index over 1-, 5-, 10-, and 20-year periods.1

3. India offers a broad opportunity set for bottom-up stock picking and long-term investors.

We believe India's growing population and young demographic — alongside its efforts to build digital, regulatory, financial and physical infrastructure over the last decade — will accelerate its long-term growth over the next decade. This will have significant implications for India's share of the global economy and equity markets.

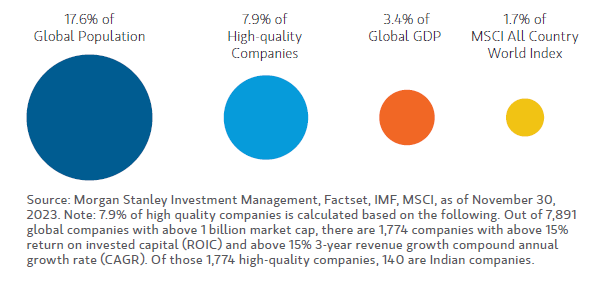

India's underrepresentation in equity indexes, and its large proportion of high-quality companies, spell market opportunity for investors. As an economy, India is likely to grow much faster than global growth, and despite quadrupling over the last two decades, India's weight in the MSCI All Country World Index is just 1.7%, trailing its current 3.4% share of global GDP. India is also home to a disproportionate number of high-quality companies, as measured by revenue growth and return on invested capital.2

India's Under-Representation Spells Investment Opportunity

Although currently underrepresented in market indexes — and perhaps underappreciated by investors in recent years — India has outperformed most emerging-market countries over the short- and long-term, as illustrated in the chart below. With numerous growth accelerators in place, we believe this performance trend should be sustained, if not outpaced.

An Attractive Hunting Ground

We have made multiple investments in India since the inception of our first strategy in 2006, across financials, consumer and industrials. As a team, we look for leading businesses with large addressable markets, opportunities to gain share and strong management teams we can co-invest with for the long term. We believe India offers an attractive hunting ground to find ideas that meet our criteria for long-term value creation. We expect the evolution of the Indian economy over the next decade will support our bottom-up ideas rather than act as headwinds, as we have seen in other emerging markets.

Bottom line: There will likely be volatility in performance, but we believe that well run, high-quality businesses in India, purchased at a discount to intrinsic value, can outperform over the long run. We see a significant opportunity for bottom-up stock picking, by owning businesses with strong balance sheets, robust growth and improving profitability.

1 Source: Bloomberg, as of December 31, 2023. The National Stock Exchange Nifty, India's broadest local index, returned 28%, 18%, 12% and 14% over the 1-, 5-, 10- and 20-year periods, respectively. Over those same time periods, the S&P 500 returned 26%, 16%, 11% and 10%, respectively. Past performance is no guarantee of future results.

2 High quality companies are defined as having greater than 15% revenue growth, compound annual growth rate (CAGR), and greater than 15% return on invested capital (ROIC).

DEFINITIONS

Compound Annual Growth Rate (CAGR) is the year-over-year growth rate of an investment over a specified period.

Gross Domestic Product (GDP) is the monetary value of all the finished goods and services produced within a country's borders in a specific time period. It includes all private and public consumption, government outlays, investments and net exports.

Gross Domestic Product (GDP) is the monetary value of all the finished goods and services produced within a country's borders in a specific time period. It includes all private and public consumption, government outlays, investments and net exports.

Return On Invested Capital (ROIC) represents the rate of return a company makes on the cash it invests in its business.

INDEX DEFINITIONS

MSCI All Country World Index (ACWI) is a free float-adjusted market capitalization weighted index designed to measure the equity market performance of developed and emerging markets. The performance of the Index is listed in U.S. dollars and assumes reinvestment of net dividends.

MSCI Emerging Markets (EM) Index is a free float-adjusted market capitalization weighted index designed to measure the equity market performance of large and mid-cap companies across 24 emerging market countries. The performance of the Index is listed in U.S. dollars and assumes reinvestment of net dividends.

MSCI India Index is designed to measure the equity market performance of the large and mid-cap segments of the Indian market. With 131 constituents, the index covers approximately 85% of the Indian equity universe.